This is due in no small part to the complexity of the tax system: the Amazon Republic collects more than 90 different types of tax, and each administrative level can levy its own taxes. In addition to the Federal Tax Authority (Receita Federal do Brasil - RFB), these are also the 27 states and no less than 5,570 municipalities. No wonder, then, that according to an investigation, there are no fewer than 51 changes in tax law in Brazil - per working day!

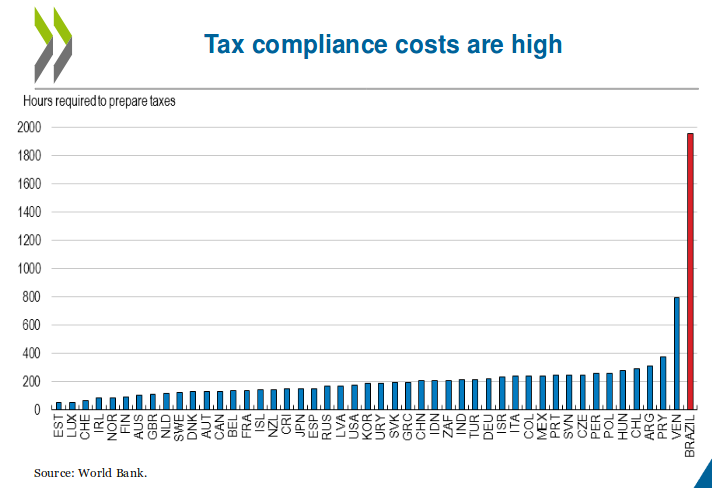

It is this almost impenetrable variety of regulations and regulations - and not only in the field of taxation - that once again gives Brazil the questionable title of the country with the most time-consuming tax system this year. The current OECD country report lists Brazil alone with almost 2000 working hours for an average company - while the OECD average is just under a tenth of this period. Companies that neglect their compliance risk high penalties: 75 percent surcharges on back tax payments are the rule - if the intention is proven, the penalty is even 150 percent. Reason enough to be careful with an ERP rollout like SAP ERP. The earlier you get help and support from proven experts who understand SAP AND Brazilian legislation, the more smoothly the project will run. One company that has this expertise is Phoron.

Two other figures from the OECD study prove that the foreclosure of the Brazilian market is still high: with an average value of over 8 percent, Brazilian customs duties are among the highest in the world. And clearing imported and exported goods takes on average four times as long as in Singapore, for example.

In addition, there are exorbitant customs duties on imported fixed and capital goods: almost 10 percent surcharge must be taken into account here. There is no higher investment capital burden in any of the markets examined by the OECD. This partitioning goes hand in hand with the aforementioned bureaucratic ramification of all administrative levels, which is reflected in an increase in the number of employees in the public service: Between 1998 and 2014, the municipalities alone hired a good three million new administrative employees. That is an increase of more than 160 percent.

The administrative hurdles are one thing: however, the language barrier also makes localization difficult. Because English can only be assumed at the management level. At the employee level - even with IT staff - only rudimentary English skills are to be expected. This opens communication gaps and misunderstandings and often leads to serious errors in the implementation phase of ERP systems in the country, the subsequent costs of which can quickly be in the six-figure range.

With the many taxes, regulations and controls, the Brazilian government tries to fight fraud and bribery. However, this also makes global reporting for companies very complex. In addition, the many tax changes require a high level of adjustment and maintenance in ERP system operation. For this reason, it is essential to bring a partner on board. On the one hand, this should mitigate the complexity of the country rollout in Brazil and on the other hand, when adapting the ERP, ensure that the standard solution is not watered down too much by country-specific adjustments. This means that follow-up costs for maintenance and update processes can be multiplied.

Phoron specializes in SAP ERP rollouts by European SMEs in Brazil. Companies from all industries benefit from:

- Over 12 years of experience with SAP implementations and rollouts in Brazil

- Local experts: Portuguese and project-capable English speaking consultants in Europe and Brazil: 15 in Europe, 30 in Brazil

- Support from a single source: holistic view and implementation of the rollouts by Phoron consultants

- 2 instead of 40 consultant days: The SAP ERP template Beyond.Brasil is tailored to the Brazilian market. Shortened throughput times and reduced test effort accelerate the rollout and reduce costs drastically.

Conclusion: An expansion to Brazil as an above-average growing emerging country is also worthwhile for medium-sized companies. This step can only be sustainably profitable if the country-specific tax and regulatory cliffs are recognized and circumvented together with an experienced navigator like Phoron.